Financial Aid Policies and Regulations

- Be a U.S. citizen or eligible non-citizen (documentation may be requested to verify your eligibility)

- Be degree-seeking in an eligible program as determined by the university

- Apply for Financial Aid each year as well as submit additional documentation as requested

- Maintain Satisfactory Academic Progress (SAP) standards

- Not be in default on a student loan

- Certify that financial aid will be used for educational purposes only

- must certify that if you purposely give false or misleading information, you may be fined up to $20,000, sent to prison, or both.

You might see a note on your Student Aid Report saying you’ve been selected for verification. CU Denver might inform you that you’ve been selected. Verification is the process of comparing the information on the Free Application for Federal Student Aid (FAFSA) application with documents that you provide to verify the accuracy of the application information. The CU Denver verification policies are used in conjunction with the US Department of Education verification guidelines.

Verification Policy:

- The policy ensures that the information provided by you (and your parents or spouse) is correct before any funds are awarded to you.

- All applications selected for verification by the US Department of Education will be verified. Others may be selected by the CU Denver Financial Aid & Scholarships Office if inconsistent information exists.

- In accordance with federal guidelines, the CU Denver Financial Aid policy is to withhold the awarding of financial aid until the verification process is completed.

Submitting Additional Documents/Information:

- Federal Direct Loans & Campus-based Aid: 30 days prior to the end of the term

- Pell Grant: The earlier of 120 days after ceasing enrollment or the federally-published deadline for Pell.

Failure to meet the verification deadlines may result in certain types of aid not being offered. In addition, delays in sending documentation may result in the student not having aid by the time their bills are due each semester. In this case, the student is obligated to pay the account balance on the student account, or their classes could be canceled.

Verification of Income Information for Individuals with Unusual Circumstances:

Individuals Granted a Filing Extension by the (Internal Revenue Service (IRS)

If an individual is required to file a IRS income tax return and has been granted a filing extension by the IRS, provide the following documents:

- A copy of IRS Form 4868, "Application for Automatic Extension of Time to File U.S. Individual Income Tax Return," that was filed with the IRS;

- A copy of the IRS's approval of an extension beyond the automatic six-month extension if the individual requested an additional extension of the filing time; and

- A copy of IRS Form W–2 for each source of employment income received for the tax year and, if self-employed, a signed statement certifying the amount of the individual’s Adjusted Gross Income (AGI) and the U.S. income tax paid for the tax year.

Individuals Who Filed an Amended IRS Income Tax Return

If an individual filed an amended IRS income tax return, the individual must provide the following:

- A signed copy of the original income tax return that was filed with the IRS; and

- An IRS Tax Return Transcript; and

- A signed copy of the IRS Form 1040X, “Amended U.S. Individual Income Tax Return,” that was filed with the IRS.

Individuals Who Were Victims of Tax Administration Identity Theft

- When the IRS determines that a tax filer has been, or likely was, a victim of identity theft, it will not allow that tax filer to obtain tax information through the use of the IRS Data Retrieval Tool or to receive an IRS Tax Return Transcript until the matter has been resolved by the IRS. Individuals in this situation must:

- Contact the Identity Protection Specialized Unit (IPSU) toll-free number at 800-908-4490.

- After the IPSU authenticates the tax filer's identify, the tax filer can request that the IRS mail an alternate paper tax return transcript called a Transcript Database View (TRDBV). This hyperlink provides a demonstration copy.

- Individuals who are victims of IRS tax-related identity theft must submit to the CU Denver:

- a TRDBV transcript obtained from the IRS; and

- a statement signed and dated by the tax filers indicating that they were victims of IRS tax-related identity theft and that the IRS has been made aware of the tax-related identity theft.

Individuals Who Filed Non-IRS Income Tax Returns

- An individual filed or will file a 2023 income tax return with Puerto Rico, another U.S. territory (e.g., Guam, American Samoa, the U.S. Virgin Islands, the Northern Marianas Islands), or with a foreign country, must provide:

- A signed copy of that income tax return(s); or

- A transcript obtained from a government of a U.S. territory or commonwealth, or a foreign central government that includes all of the tax filer’s income and tax information required to be verified for the tax year.

IRS Verification of Non-Filing Letter

Why is this being requested by the Financial Aid & Scholarships Office?

Your FAFSA has been selected for a review process called verification. The U.S. Department of Education is now requiring students and parents that indicate on the FAFSA they did not file a tax return to provide a Verification on Non-filing Letter from the IRS. If the student and/or parent(s) did not and will not file a federal tax return, a Verification of Non-filing Letter must be obtained from the IRS for each non-filer. For the 2025-2026 academic year, the letter must be for the 2023 tax year.

Once you have obtained a Verification of Non-Filing Letter from the IRS, please submit it to the Financial Aid & Scholarships Office. We encourage you to keep a copy of the letter for your records.

How do I obtain the IRS Verification of Non-filing Letter?

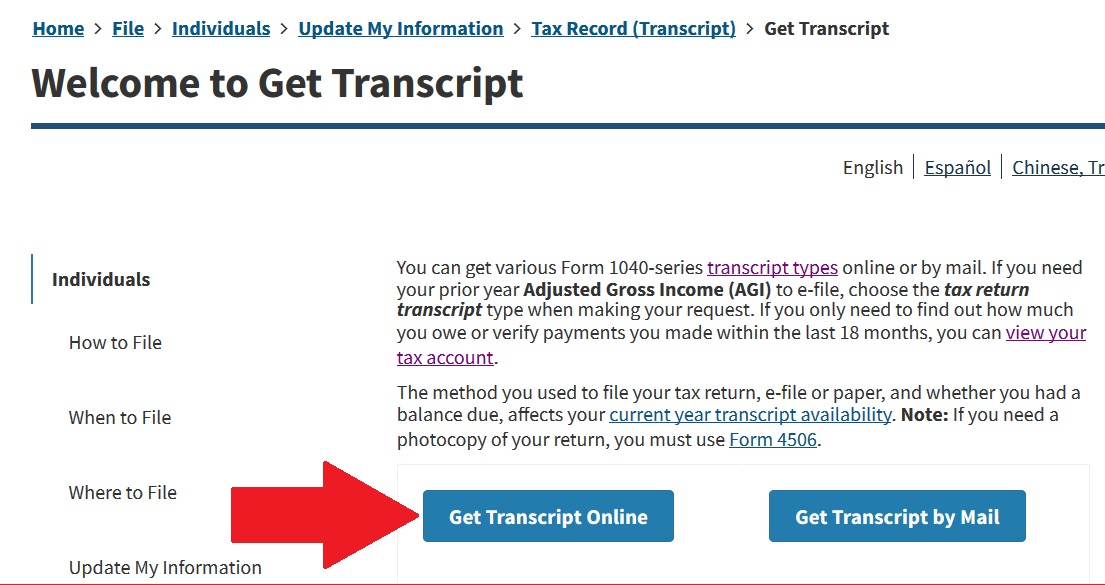

- Obtain the IRS Verification of Non-filing Letter

- Click “Get Transcript Online”.

- Follow the instructions to verify your identity if you haven’t used the service before.

- As you proceed through the screens, a confirmation code will be sent to your email address. You will need the code to enter on the next screen.

- After entering the code, you will be prompted to select a reason the transcript is needed. Please select Higher Ed/Student Aid and the applicable tax year.

- If you are unable to successfully obtain your document online, you may use the mail or phone request options.

- Phone the IRS Helpline at 1-800-908-9946. Request a Verification of Non-filing Letter.

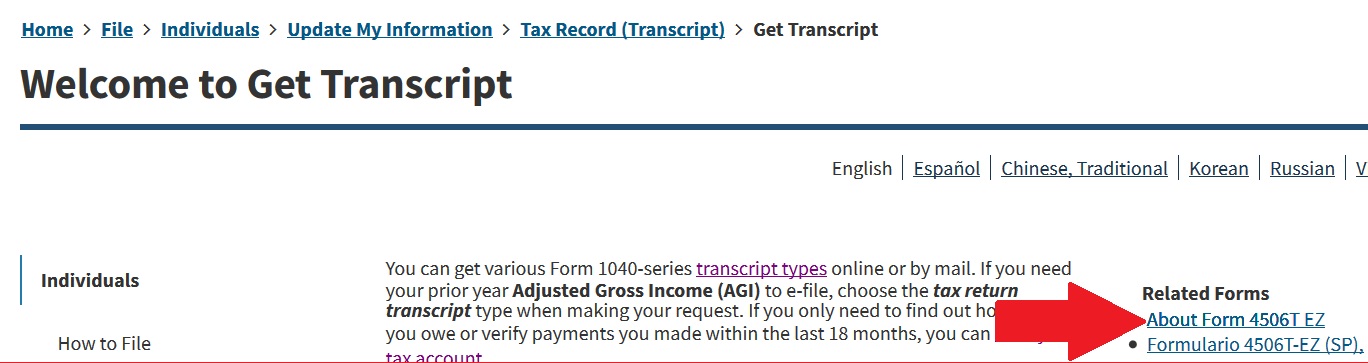

- Postal Mail by completing Form 4506-T

- The form is available in the “Related Forms” sidebar on the right side of the screen.

- Click the Form 4506-T.

- Complete sections 1 through 4.

- Select Verification of Non-Filing in section 7.

- Indicate 2015 as the period being requested.

- Sign and date the form.

- Mail or fax the 4506-T to the appropriate address by state listed on page 2.

We encourage individuals to request the Verification of Non-Filing Letter be mailed to them directly in contrast to using the third party request option.

Corrections and Notifications:

- Corrections made by the CU Denver: If the verification process results in corrections to any items on the FAFSA, the Financial Aid Office will submit those changes electronically. You will be notified of the changes through email from the FAFSA Central Processor. The Financial Aid & Scholarships Office will award the financial aid funds based on the corrected FAFSA results.

- Corrections made by you: In the event that you must make corrections or additions to your FAFSA, the Financial Aid & Scholarships Office will contact you to make the appropriate corrections at StudentAid.gov. Corrections that you choose to make after you have been awarded financial aid will not be processed.

- The To Do List in Student Center of the UCDAccess will list any additional documents or information requested.

- In addition, an e-mail reminder is sent to your university webmail account when additional documents or information are requested.

Unusual Enrollment History Flag

The US Department of Education has established regulations to prevent fraud and abuse in the Federal Pell Grant Program and the Federal Direct Loan Program by identifying students who attend an institution long enough to receive a Title IV credit balance, leaves without completing the enrollment period, and then enrolls at another institution, with unusual enrollment histories. Please note that Direct Consolidation Loans and Direct Parent PLUS Loans are not considered in this review.

The specific pattern used to select students includes those students who have received a Federal Pell Grant or a Federal Direct Loan at multiple institutions during the review period, which includes the four most recent award years. If selected by the Department of Education, the unusual enrollment history must be resolved before the student can receive federal financial aid.

UEH Flag Values and Resolutions:

UEH Flag Value of ‘N’: There is no unusual enrollment history. No additional action is required by the school.

UEH Flag Value of ‘2’: The Financial Aid & Scholarships Office must review your enrollment and financial aid records to determine if, during the four award year review period, you received a Pell Grant and/or Federal Direct Loan at CU Denver.

- If so, no additional action is required. However, if there is reason to believe you remained enrolled just long enough to collect student aid funds, we must follow the guidance for a UEH Flag value of 3.

- If not, we must follow the guidance for a UEH Flag value of 3.

UEH Flag Value of ‘3’: The Financial Aid & Scholarships Office will use information from the National Student Loan Data System (NSLDS) to identify the institutions you receive Pell Grant and/or Direct Loan funding during the review period. We must also review your academic records to determine if you received academic credit at each institution. We will contact you if we need copies of any transcripts.

- Academic Credit Earned: If we can determine you earned any academic credit at each institution attended during the review period, no further action is required, unless there is reason to believe you remained enrolled just long enough to collect student aid funds. In these instances, or if we cannot determine you earned academic credit, you must provide additional information discussed below under "Academic Credit Not Earned."

- Academic Credit Not Earned: If you did not earn academic credit at one or more of the institutions attended during the review period, or at CU Denver, you must provide a signed statement explaining why you failed to earn academic credit. Please include any documentation to support your statement. If you cannot provide satisfactory documentation explaining your failure to earn credit, you will not be eligible to receive any additional assistance from federal Title IV programs, or state and institutional programs.

Right to Appeal:

If you have been determined to be ineligible for federal student aid on the basis of (or lack of) documentation, you may resubmit additional documentation for reconsideration.

Regaining Federal Student Aid Eligibility:

Your eligibility for federal student aid may be reconsidered after successfully completing a minimum of 12 credits (undergraduate students) or 5 credits (graduate/professional students) that are required by your program. Successful completion is defined as a grade of C or better. Grades below C, incompletes and withdrawals are not considered successful completion. You must also meet the standards for Satisfactory Academic Progress (SAP).

How Financial Need is Calculated

Before we can determine your award package, we must first determine your financial need. Financial need is the difference between your Cost of Attendance (COA) and your Student Aid Index (SAI) which is calculated by the U.S. Department of Education and reflected on your FAFSA.

The Cost of Attendance is an estimate of the educational expenses incurred by the student during the academic year. A standard COA may include costs for tuition, fees, books, health insurance, room and board, transportation, and personal expenses.

Your SAI is determined by many factors, including the family’s income, assets, size and number in college. If you are independent, “family” refers to yourself and your spouse/children (if applicable).

How Financial Aid is Awarded

Most initial awards are based on the assumption that student will enroll full-time for both fall and spring semesters. The amount and type of financial aid offered is based on several factors including your financial need and the availability of funds. Most funds are distributed on a first-come, first-served based on availability funds. Funds are awarded in the following sequence:

- Financial assistance from university departments or schools or outside sources including tuition remissions, trainee-ships, stipends, tuition waivers, and tuition assistance

- Scholarships from the university and outside agencies

- Grants (federal, state and institutional)

- Federal Work-Student and/or Perkins Loan or institutional loan

- Federal Direct Loans including subsidized, unsubsidized, Parent PLUS, and Graduate PLUS

If you enroll part-time, or only attend one semester, some of your awards may be reduced or canceled

Students receiving financial assistance from university departments or schools or outside sources may not be eligible to receive federal, state. or institutional financial aid.

Nonresident students are not eligible for state grants, but may be eligible for institutional grants and loans depending on your program of study. See types of aid you can qualify for as a nonresident student.

Award Notification

New and Prospective Students

We will begin sending notification emails to new and prospective students in March or April letting you know that your Estimated Award Notice is available on UCDAccess. Emails will only be sent to your university email account. You must submit any requested documents before we can calculate a new financial aid package and send you an Official Award Notice. Your Official Award Notice will provide you with instructions for viewing and accepting your awards, as well as next steps. Please note your official award may be reduced or canceled if you do not submit all requested documents.

Continuing Students

We will begin sending notification emails to continuing students by May. Emails will only be sent to your university email account and will provide you with instructions for viewing and accepting your awards, as well as next steps. If you are asked to submit additional documents, you can find them on your To Do List on UCDAccess.

We recommend you save an electronic or printed copy of your Award Details page any time there is a change. Keeping a record of the awards you received may help you for future reference. Please contact our office if you have any questions regarding your financial aid award package.

Most financial aid programs require that you be enrolled at least half-time to be eligible.

After census day the Federal Pell Grant and Teacher Education Assistance for College and Higher Education (TEACH) Grant amounts are adjusted based on your actual enrollment. Adjustment levels are based on enrollment intensity. To learn more about enrollment intensity calculations visit this Federal Student Aid site. The census date is listed on the Academic Calendar.

Wait-listed or audited courses do not count as enrolled courses.

Award Adjustments

Throughout the year it may become necessary for the Financial Aid and Scholarships Office to adjust your financial aid award if the total amount of aid received exceeds your estimated cost of attendance (COA). You will receive a revised award letter if your financial aid award has to be adjusted. Below are some of the more common reasons your aid may have to be adjusted. Notify the Financial Aid & Scholarships Office immediately if you receive financial assistance not reflected on your award summary, or if you notice any discrepancies in your award letter.

| Minimum Full-time | Minimum Half-time | |

| Undergraduate students | 12 hours | 6 hours |

| Graduate students* | 5 hours | 3 hours |

| Professional students | 10 hours | 5 hours |

Note: One thesis or dissertation credit is considered full-time enrollment.

We will review your enrollment status after the term census date.

- If you are enrolled less than full-time after census, your student budget for fall and spring will be adjusted to reflect your current enrollment status. Additionally, your financial aid package may have to be reduced. If you receive an additional credit balance refund as a result of you dropping classes, we strongly recommend that you do not spend those funds until we have made any necessary adjustments to your account

- If you're enrolled for more than the full-time hours indicated above and need additional funds, please submit the Loan Adjustment Form to request an increase in your loans. We will review your eligibility for additional federal loans or alternative student loans

Receiving Other Financial Assistance:

It's important to remember that any financial assistance you receive for being a student must be coordinated with the Financial Aid & Scholarships Office. We are required to reevaluate your financial aid award if we are notified that you are receiving scholarships, tuition assistance, stipends, employer tuition waivers or any other form of aid. We may have to adjust your award package if the additional aid exceeds your cost of attendance or your financial need. We will attempt to make any necessary adjustments prior to the release of any credit balance refund. However, if you receive an additional or unusually large credit balance refund, you may be required to return at least a portion of those funds to the university. We will use the additional aid amount to repay the new balance.

- Stipend Payments

- Service (Work-related) Stipends are payments to a student who is required to perform services in order to receive the payment. Service stipends are not included in calculating a student’s eligibility for financial aid

- Non-Service Stipends are amounts paid to individuals who do not provide any services and which are not academic awards. Non-service stipends paid to a student must be included in calculating a student’s eligibility for financial aid

Corrections on the FAFSA:

Whenever our office receives information that does not match what was reported on the FAFSA, we are required to review the information and determine if a correction to your FAFSA is required. These changes may impact your financial aid eligibility.

Loan Distribution

The university must distribute Federal Direct Loans for student enrolled in an undergraduate program and:

- The entire program of study is less than a full academic year (fall/spring)

- The program of study is greater than a full academic year, but the student’s final period of study is shorter than an academic year (the student is scheduled to graduate at the end of the fall semester)

Sample Loan Distribution Calculations:

- Dependent undergraduate student:

- [12 credits taken ÷ 24 credits in Academic Year (AY)] x $5,500 subsidized loan = $2,750

- [6 credits taken ÷ 24 credits in AY] x $2,000 unsubsidized loan = $1,000

- Independent undergraduate student:

- [15 credits taken ÷ 24 credits in AY] x $5,500 subsidized loan = $3,437

- [9 credits taken ÷ 24 credits in AY] x $7,000 unsubsidized loan = $2,625

Change in Residency:

Financial aid awards will be reviewed and adjusted, if necessary, for non-resident students that petition and are approved for Colorado residency.

Once your residency petition is approved, the Bursar’s Office will adjust your tuition charge which will generate a credit balance refund. We attempt to make any necessary adjustments prior to the release of this refund. However, if you receive an additional or unusually large credit balance refund, you will be required to repay at least a portion of those funds. Failure to repay the bill in a timely manner may result in you being assessed service charges and possibly going into collections. To avoid this, please contact our office once you have been notified that your residency petition has been approved.

Attending for Only One Semester:

Typically financial aid is offered for the fall and spring semesters. Please notify our office if you decide not to attend in the spring semester due to graduation or other circumstances so we may adjust your award for one term. This may

result in you owing aid back to the university.

We recommend you save an electronic or printed copy of your Award Details page any time there is a change. Keeping a record of the awards you received may help you for future reference. Please contact our office if you have any questions regarding your financial aid award package.

Financial aid funds are disbursed to your student account no sooner than 10 days before the start of each semester, provided all requirements, including all applicable promissory notes and entrance counseling, have been satisfied and you are enrolled at least half-time. Outstanding requirements are listed on the To-do List located in the Student Center on the UCDAccess portal. The Financial Aid and Scholarships Office communicates with students via email regarding all additional information needed.

Scholarships, grants and loans administered by the Financial Aid and Scholarships Office are first applied directly to your student account to pay for tuition, fees, university-operated housing, and other university charges.

Students whose financial aid exceeds the charges on their student account will receive the remaining credit balance (referred to as a "refund") to pay other educationally related expenses in accordance with the Bursar's Office refund process. Please read the Financial Aid Usage Authorization section below.

To set up direct deposit:

- Log into your UCDAccess Portal

- In the top right, in the menu, click "CU Resources"

- Select "Paychecks"

- Select "Direct Deposit" on the left-hand side

- Follow the instructions and enter your account information

Returning Excess Funds After Disbursement:

You may reduce or cancel your loans through the university within 45 days of disbursement. The steps are as follows:

- Submit the completed and signed Loan Adjustment Form to the Financial Aid and Scholarships Office. This adjustment may create a balance owed on your student account.

- You will receive an email notification once your request has been processed. You may then pay the balance due. Please refer to the Billing Guide for information about paying your bill.

You must contact your loan servicer to return funds if it has been more than 45 days since disbursement. Please contact our office if you have questions about this process or completing the Loan Adjustment Form.

Disbursement of Books and Supplies Policy for Pell Eligible Students

All Pell eligible students who have been awarded financial aid at least 10 days before the beginning of the term, who have registered for courses, and whose awarded aid is in excess of charges billed by the university for those courses, may use their excess funds to purchase books and supplies.

Students should be aware that enrolling at a lesser status than the enrollment status used to award the aid may require that the award be adjusted to match the new enrollment status, which will lower any excess aid amount. Students should also be aware that changes in their enrollment status after the disbursement of funds may result in lowered or no eligibility for financial aid funds and thus the student may owe the university a return of some or all of the funds disbursed for books and supplies.

All enrolled CU Denver students may charge up to $500 for books and supplies at the Tivoli Station.Visit the Tivoli Station webpage to learn about the CU Denver Charge Program.

Check your student UCDAccess portal. If you were awarded a Federal Pell Grant award at least 10 days prior to the start of the term and have not yet received the projected excess aid funds by the first day of the term, please contact the Financial Aid and Scholarships Office for assistance.

Authorize Financial Aid to Pay All Charges

Federal and state regulations require students, and parents of

dependent students, to authorize the university to apply any federal or

state financial aid funds to allowable educationally related charges

other than tuition and fees. These charges include but are not limited

to health insurance, service charges or drop fees. By granting the

university authorization to pay these charges with federal and state

financial aid funds, you may avoid unpaid balances that could result in

additional service charges. You may cancel or modify an authorization at

any time. This is a one-time authorization which will remain in effect

until revoked.

Students may complete the Financial Aid Usage

Permission in the UCDAccess portal. Instructions to complete the

authorization are available within the Bursar's Office webpage.

Federal regulation permits state and federal aid to pay for tuition and mandatory fees. If a student, or parent borrowing a Direct Parent PLUS Loan would like aid to pay for "allowable educationally-related charges" such as health insurance, service charges, and course drop charges, the student and parent borrower (if applicable) should complete the Financial Aid Permissions Form to authorize aid to pay all charges.

If you do not complete authorization, the university must assume that you wish to restrict use of your financial aid funds. Although you may receive a credit balance refund, you may still owe a balance to the university.

How to Complete the Authorization - Students

Students may complete the Financial Aid Permission Form through the UCDAccess Portal.

Instructions to complete the authorization are available on the Bursar's Office webpage.

How to Complete the Authorization - Parents

Parents that have borrowed a Direct Parent PLUS Loan should contact the Bursar’s Office to complete the Financial Aid Permission Form.

How to Cancel Authorization

Students may cancel the authorization through UCDAccess.

Parents should contact the Bursar’s Office to cancel the authorization.

Federal and state financial aid regulations require that students meet the

Satisfactory Academic Progress (SAP) Standards to be eligible for financial aid.

The purpose of SAP is to ensure academic success and graduation. Students who do not meet the SAP standards are not eligible for aid.

To learn more, review our SAP Policy.

CU Denver Satisfactory Academic Progress PolicyIn compliance with the Family Educational Rights and Privacy Act of 1974 (FERPA), the disclosure of information from a student’s educational record is considered confidential and will not be released, with certain exceptions, without the student’s written permission. If you would like to authorize the university to release financial aid and enrollment information to your spouse, parents, or other family members, you must first provide written consent. Students may provide FERPA consent electronically through the profile section of the UCDAccess portal. Students who prefer to complete a paper version of the consent form should complete the Release of Confidential Information Request Form and submit the form to the Office of the Registrar.

Students may delegate read-only online access to family members or third parties through the CU Guest Access section of the UCDAccess portal. Navigation instructions for CU Guest Access are available through the Office of the Registrar’s webpage. CU Guest Access does not authorize a guest to contact the University to request or discuss your student education record. Student record information can only be accessed by a family member or third party if the student has filed a FERPA Consent to Release form.

If you would like the Financial Aid and Scholarships office to release your information directly to an outside agency, you must complete the Authorization to Release Information To Outside Agencies Form for the appropriate school year, and return the form to the Financial Aid and Scholarships Office. If you would like paperwork completed and returned directly to you, the authorization is not required and paperwork will be sent to your university email once completed.

For more information on Privacy of Student Records (FERPA), read the Privacy of Student Records for the University of Colorado Denver Campus.

State and Federal Regulations and Resources

Financial Aid & Scholarships

Located in Lynx Central

CU Denver

Student Commons Building

1201 Larimer Street

#1107

Denver, CO 80204

303-315-5969